Many questions come to mind when you are getting your car insurance. Questions like:

- What do all these numbers like 100/300/100 mean?

- What is an umbrella policy and do I need it?

- How much coverage do I really need?

That third question is one that we all face. We know how much we want to pay — as little as possible so it doesn’t hurt the budget too much. We know how much the highway patrol requires — hopefully. However, that might not be enough. Let’s take a look.

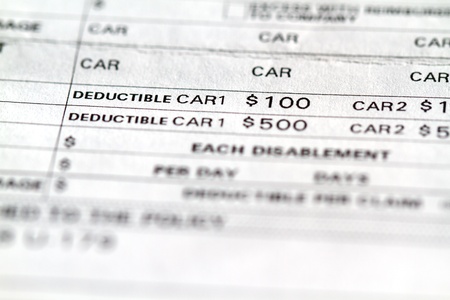

Low Deductible vs. High Deductible

The most commonly chosen deductible for vehicles is $500. We recommend, however, that you should do a break-even analysis. You might consider raising your deductible to save money. The national average for car claims is 7 years. Divide the change in deductible by the amount of savings. If it is greater than 7 years, it’s probably not a good thing to do.

The actual savings of raising your deductible can vary from one insurance company to the next and it depends on too many variables for us to actually use accurate numbers here. However, let’s make up some numbers.

If you raise your deductible to $1000 per year, let’s say that saves you $50 per year. Your break-even:

$500/$50 each year = 10 years to break even

The national average of having an auto claim is 7 years, so that’s probably not a good thing to do. But what if raising your deductible saved you $150 per year?

$500/$150 each year = 3.3 years

Raising your deductible might be a good idea in this case. You should contact us to get actual rates. In addition, our experienced agents will be able to help you choose exactly the best coverage for YOU. (And we’re also happy to answer all the questions you may have about it!)

How Much Insurance Do You Need?

Low vs. High Deductible

Liability Insurance

Collision and Comprehensive Coverage