In Parts 1 and 2, we talked about deductible and liability coverage. There are two other coverages that you should consider.

Collision & Comprensive Vehicle Insurance

You may remember that liability car insurance covers the medical and property damages to others. Collision Car Insurance covers your vehicle such as if you hit an object like a fence or pole. It also covers damage to your car if someone else hits you, and they do not have liability insurance. Collision car insurance also covers your vehicle if you are at fault.

Comprehensive covers other damages. If your vehicle is stolen and not recovered, that is covered under comprehensive. It also covers damages from weather (tornado, hail, etc.), floods, fire, falling objects, explosions, crashes with an animal (such as a deer) and even riots and civil disturbances.

Do I need Collision or Comprehensive vehicle coverage?

This decision is really up to you. Our experience has been that most people drop collision or comprehensive (or both) when their car’s value drops below $2,000-$3,000. It is simply a matter of value. Add the premium to the deductible if you should have an accident. If the total is greater than the value of the vehicle, some people choose not to get collision and/or comprehensive coverage.

There are some situations where we recommend getting collision and comprehensive coverage. These include:

- If you take out a loan to buy your car, the lender may require these coverages.

- If you lease your car, the leasing car may require these coverages.

- If you cannot afford to replace or repair your car if you crashed or it was stolen.

- If your area has a high incidence of car theft, vandalism or the other situations described above.

I’m just not sure about all these coverages. What do I do?

This question is why we are here for you. Click here to contact us or give us a call at 865-922-3111 or 800-624-3339. We can provide the information to help you make the best decision for the right coverage at the right price. In addition, because we are an independent agency, we can show you quotes from many different insurance companies so that you can choose the right one for you.

How Much Insurance Do You Need?

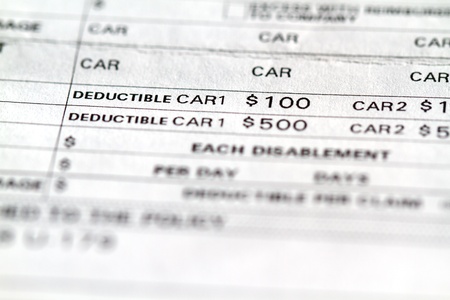

Low vs. High Deductible

Liability Insurance

Collision and Comprehensive Coverage