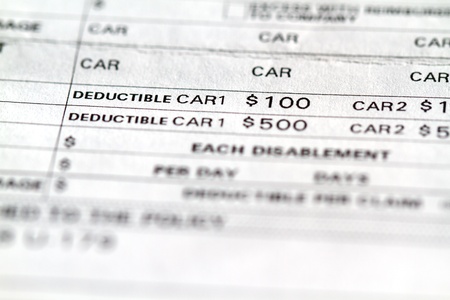

In Part 1, we discussed deductibles and what you should consider regarding a low vs. high deductible. A second very important part of your vehicle coverage is liability.

What is Liability Insurance?

Liability car insurance covers damages to another person that result from an accident you cause. It is one of the most base types of coverage and is also mandatory in every state. The actual minimum limits of coverage can vary state-to-state.

Understanding Liability coverage

Liability coverage is represented by three numbers. It might appear as 25/50/15 or 100/300/100. Knowing what these numbers mean is very important.

The first number is maximum paid for “bodily injury” to the other person per accident. (Think in terms of medical expenses for this one.)

The second number is the “maximum paid per accident.” Add up all the costs the insurance pays, and it cannot exceed this amount.

The third number is the maximum paid for “property damage” to the other person’s vehicle as well as any other property damage done (such as fences, guardrails, buildings, etc.)

How much Liability Insurance Coverage do I need?

Although the minimum limit may be lower, a very common liability amount chosen is 50/100/50. However, we recommend that you make your liability coverage as high as you can afford. It’s in your interest to do so.

Let’s consider if you were in an accident in which you totaled the other person’s vehicle. Costs might include:

- The vehicle

According to USA Today, in 2014 the average used car price was almost $17,000. - Ambulance to the hospital to get checked

Ambulance rides can cost from $500-$2000 depending on where you are and what is required. The L.A. Times reported that one lady’s insurance company covered $750 for her ambulance ride and she had to pay over $1500 for the rest of the cost. - Medical Costs (emergency room, hospital, x-rays, tests, etc.)

One of our customers spent just one night in the hospital last fall. By the time all the costs were added up, the bill was over $9000. That’s just for one night to get checked out and monitored.

While all of these are very general numbers, they add up quickly. Liability costs from an accident can quickly reach $25,000 or more. If you are carrying the Tennessee minimum (25/50/15), all those expenses would be covered. However, what if it was a new car worth $35,000? What if there are extensive injuries requiring a several nights stay in the hospital followed up by physical therapy and other doctors visits. With the minimum coverage, the maximum the insurance pays is $50,000. You are liable for the rest.

Being Realistic

We are not trying to be scary here. It’s important to be realistic about what liability can mean. Your budget may determine how much coverage you carry. However, if you have the ability to carry more, we recommend that you do.

Our hope, of course, is that none of us has an accident. How much Liability Coverage should you have? Talk to your insurance agent about the right amount for you. They can answer any questions you have about it as well. If you would like, contact Bob Johnson Insurance. We have several experienced agents who can help you decide what is right for you.

How Much Insurance Do You Need?

Low vs. High Deductible

Liability Insurance

Collision and Comprehensive Coverage